Now is the time to be meticulous in understanding your business’s relationship with the various sectors of the macro economy. The

backside of the business cycle can afford you the time to adjust. With today’s relatively low interest rates, it is still a good time to invest in your business, particularly given the growth expected throughout much of the macro economy during the next three years.

Implement improvements and efficiencies in 2022 and 2023 while activity is slower than in recent quarters.

Residential Construction

U.S. Single-Unit Housing Starts totaled 1.123 million units for 2021, coming in 13.4% above the 2020 level. Last year was the highest-volume year for housing starts since 2006. Even so, the 2021 new construction total includes some late-in-the-year stagnation, with the 12-month moving total dropping about 1.5% from the August level by year-end. We expect the rise to resume in the near term and persist until at least 2024. However, the pace of rising will be slower this year than in 2021.

U.S. Home Prices continue to climb, backed by a strong consumer, low mortgage rates, and limited inventory. However, the pace of rise for quarterly home prices has ticked down. Nascent business cycle decline in home prices is in line with the overall slowing growth trend in housing starts.

Mortgage rates are another important factor for home buyers. Rates depend on many factors, including the Federal Reserve’s monetary policy, inflation, and bond market conditions. The recent rise in long-term rates, combined with inflationary pressures taking a bite out of consumer purchasing power, will contribute to less-robust growth rates for the housing sector in 2022 than in 2021.

However, less-robust growth is still growth. Despite the recent rise, mortgage rates are still low relative to historical norms, and consumers have savings they can tap. Furthermore, the strong jobs market will enable consumers to purchase homes.

Use this time of slowing growth to prepare your business for subsequent years. Improve corporate governance, create hiring and retention plans, and make capital investments.

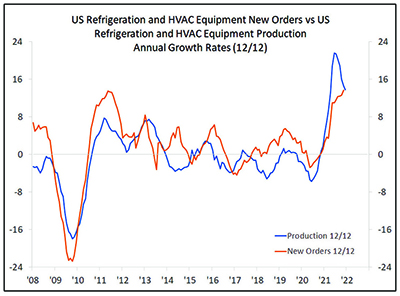

U.S. Refrigeration and HVAC Equipment

Be careful when looking at New Orders and actual Production for U.S. Refrigeration and HVAC Equipment – the trends are not as aligned as you might think. Annual new orders totaled $52.1 billion in November, up 13.7% from last year. Overall production for 2021 was up 13.8% from the 2020 average, seemingly in line with new orders.

Expect annual new HVAC equipment orders to rise through 2022 generally but will grow at a slowing rate throughout the year.

In contrast, annual new equipment production will rise into the middle of this year before declining into 2023.

Softening demand in the U.S. housing sector is applying some downward momentum to both new orders and production, but there are three main factors for the differences that you should be aware of.

- Pricing

- Supply Chain Woes

- Multiple Orders.

Click Below for the Next Page

Recent Comments