Eric Howarth

Let’s face it, it is easy to put your own preconceived notions on your customers. I see this all the time when working with contractors. Often sales people focus more on what they are comfortable with versus the underlying needs of their customer. When it comes to financing, it is important to first understand the different types of homeowners and then follow a methodical financing process to cover them.

Let’s explore who your customers are and how successful contractors use financing effectively to upsell and close more sales. Using financing correctly allows you to price right and close the High-Performance HVAC project.

There are three types of customers you need to address:

-

What percentage of homeowners in the US live paycheck to paycheck? * (That’s 3 out of 4 people.)

* CNN Money Findings (1)Cash customers

- Payment plan customers

- Credit challenged customers.

Nobody likes to write a big check, regardless whether they have the cash or not. The fact is, 75% of all homeowner’s live paycheck to paycheck1. You cannot tell if someone has money in the bank by just looking at them.

Cash Customers

Every sales person has a story about a customer living in a trailer who keeps $10,000 in their mattress for the project, or the customer who lives in a fancy house or has a fancy car who couldn’t afford the project or get approved for financing. This is why it is so important to leave preconceived notions at the door.

By building a selling system using financing, you can help each one of your custumer types. Your plan can offer a low monthly payment at 10 years or longer, a no interest no-payment option, or a second look option for low credit scores. With each option offered on every sales call, contractors typically see 20% larger projects and a 30% increased close rate.

By building a selling system using financing, you can help each one of your custumer types. Your plan can offer a low monthly payment at 10 years or longer, a no interest no-payment option, or a second look option for low credit scores. With each option offered on every sales call, contractors typically see 20% larger projects and a 30% increased close rate.

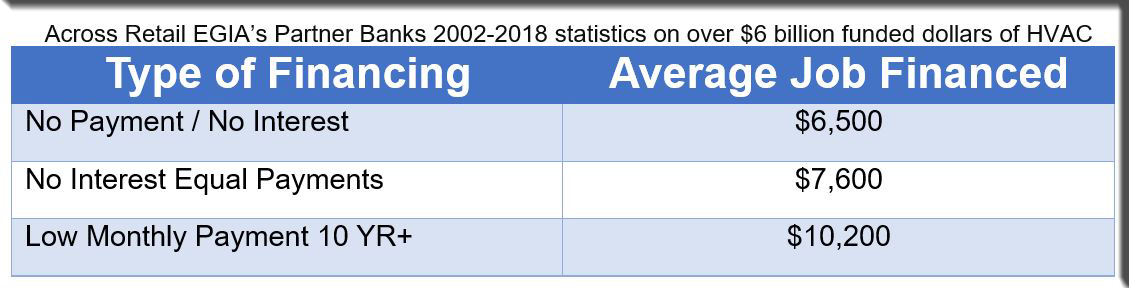

The other trap that many sales people fall into is thinking they want customers to pay cash. The fact is financed project transactions on average are up to $2,000+ larger. Offering a 10-year plus term loan can get the payment to around $100 per month for the homeowner — which is often the difference between repairing and replacing the project.

Payment Plans

Don’t feel bad about putting someone into a 10-year loan at a reasonable interest rate because most pay off that loan within 4 years. The low payment simply allows the customer not to feel burdened by a large monthly payment. It also provides the flexibility to pay it off in their own time with tax returns or wage increases.

Also, HVAC done right saves the customer money on their monthly bill and that can often be used to demonstrate a lower monthly investment in a Best, Better, Good scenario.

Also, HVAC done right saves the customer money on their monthly bill and that can often be used to demonstrate a lower monthly investment in a Best, Better, Good scenario.

Sales people, however, often insert their own preconceived notions on low monthly payments with regard to how long a loan they personally would take and at what interest rate.

Sales people, however, often insert their own preconceived notions on low monthly payments with regard to how long a loan they personally would take and at what interest rate.

The better approach is to be methodical and provide the customer choices. After nearly 20 years of training dealers on financing, I find nothing as transformative to the contractor’s bottom line as effectively offering low monthly payments.

Even customers with the cash to pay for projects suffer from ‘cash separation anxiety.’ Taking money they worked so hard for out of their savings or checking account can be daunting. Often ‘sticker shock’ can be the difference between closing a smaller project/system repair, or replacing the HVAC system the correct way.

No payment/no interest same-as-cash loans are a great way to give cash customers the ability to defer project costs until their bonus check comes in. When offered in conjunction with low monthly payments, same as cash loans will be about 30% of the mix. Think about how powerful it can be to say, ‘We can install the project this week and you will have no interest and no payments until 2020.’

Second-Look Loans

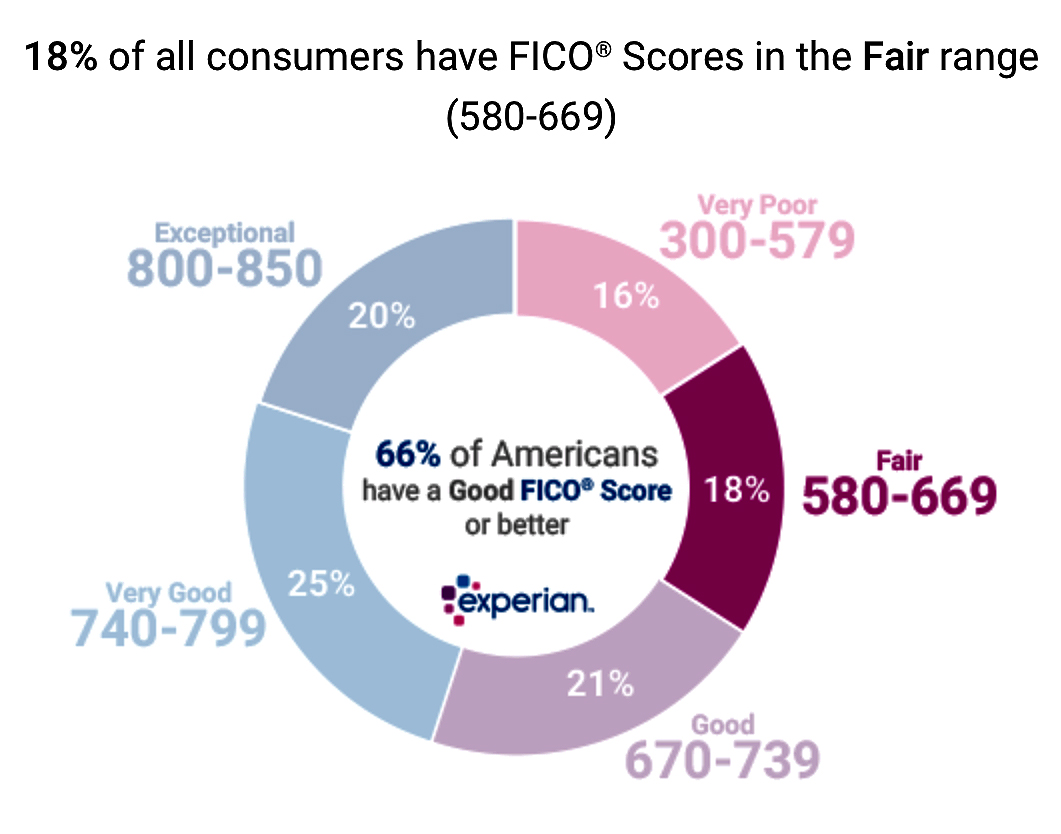

The fact is around 20% of your customers will need ?2nd look financing.’

So, if you stop at ‘First look or ‘A’ paper’ financing options, you’ll be giving up a huge opportunity. Many ‘First look or ‘A’ paper’ providers now have an optional second look on their technology platforms.

So, if you stop at ‘First look or ‘A’ paper’ financing options, you’ll be giving up a huge opportunity. Many ‘First look or ‘A’ paper’ providers now have an optional second look on their technology platforms.

Keep in mind, whether you use their built-in option or another second-look provider, you need some preplanning for higher discount fees or get ready to have a discussion with the customer about a much higher interest rate.

That fact is most of your customers know when they have a credit problem and as a result understand that their options are limited. Do not be afraid to have this conversation with a customer because it can mean an increased approval rate of up to 15%.

Another fact: the top 10% of the HVAC contractors do 80% of all the financed transactions. They know the increased margin allows them to get to higher wages for their employees and money for marketing to drive leads. Being methodical by offering financing with a low-payment/no-payment option, and using 2nd-look financing is a proven way to grow your business. It’s often the gateway drug to a prosperous successful HVAC company.

Eric Howarth

Eric Howarth is Vice President of Contractor Services, responsible for developing and executing Electric and Gas Industry Association’s (EGIA) overall contractor services strategy. He also leads the ongoing development and management of EGIA’s Contractor Membership and GEOSmart Financing Clearinghouse. Eric has facilitated over 6 billion dollars in energy efficiency and renewable energy financing through EGIA’s extensive network of manufacturers, distributors, utilities, and contractors.

Recent Comments