In my 40+ years of writing about this industry, several topics have always been at the top of the trends list. These include: workforce issues, technology, and the environment. As one of my favorite bands used to sing, “The Song Remains the Same.”

Led Zeppelin’s 1973 hit was an ode to the power of music. The major trends in the HVAC Industry seem to be odes to the power of creative solution-finding. The good news: it bodes well for the HVAC contracting industry in general and the High-Performance HVAC™ segment of the industry in particular.

Zeppelin Lyricist Robert Plant wrote, “Everything that’s small has to grow, and it’s gonna grow .” When it comes to the top three trends, that is also true.

Some Economic Basic Trends

With a new presidential administration in place, some changes will come in 2025 that aim to help Americans in general and commercial HVAC businesses in particular.

Inflation has been a significant problem. It seems to be easing (especially with the Federal Reserve reducing the prime rate by a decent percentage). However, consumers still feel the pinch on their wallets.

That may impact their ability to invest in new replacement equipment and duct renovations. It also may lead to more investment in repairs, air upgrades, and so on.

Having said that, Grand View Research, in their 2024-2030 Market Analysis Report, says that the U.S. HVAC systems market size was estimated at $30.41 billion in 2023. They projected it to grow at a compound annual growth rate (CAGR) of 7.4% from 2024 to 2030.

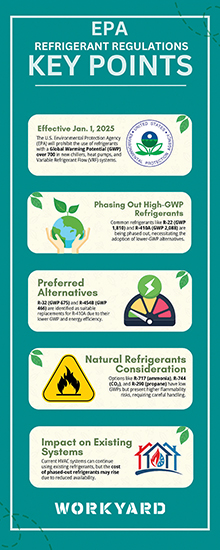

The report also states, “Global warming and the resultant extreme climatic conditions will help uptick the market demand over the forecast period. In addition, the demand for energy-efficiency equipment, together with the growing real estate market, will also upkeep HVAC demand in the U.S.

“Moreover, the increasing demand for energy-efficient equipment, coupled with the growing real estate market, is expected to increase the demand for U.S. HVAC systems.”

The Service Component

Eric Post of ITR Economics wrote in October that his organization sees the service component of the U.S. gross domestic product (GDP) will remain near 2024 levels, with slight increases above 2%. He says three factors will fuel the slight growth:

- Rising real personal incomes amid a generally tight labor market

- A boost from a recovering inflation-adjusted money supply

- Spending from higher-income households fared relatively better in this business cycle amid elevated home prices, stock valuations, and corporate profitability.

Click Below for the Next Page:

Recent Comments