If you’ve been following the forecasts for 2026, the one thing I’ve noticed is the number of mixed outlook signals being bandied about. Some analysts predict a slow start. Manufacturers are cautiously optimistic. Housing remains uneven. Plus, homeowners are more price-sensitive and, in many cases, are trying to get one more year out of HVAC systems that are clearly past their prime.

From where I sit, all of that may be true. But here’s the part that matters most:

The 2026 outlook won’t be bad for the residential HVAC Industry. It will simply be a challenging year for those contractors who focus only on new installations and equipment change-outs.

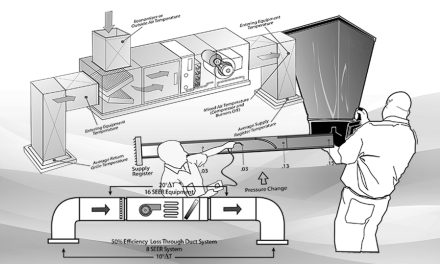

What does that mean? With all the changes in the marketplace, success comes down to one thing: “If You Don’t Measure, You’re Just Guessing™.

With that in mind, I believe that residential High-Performance HVAC™ contractors and the trends heading into 2026 align perfectly with the way you already operate — by testing, commissioning, and verifying system performance.

Key Market Outlook Indicators and Opportunities

One market outlook study by Research and Markets Research Store highlights a number of factors that will heavily impact the residential HVAC marketplace, including electrification, refrigerant transition, IAQ and ventilation, controls, installer capabilities, and the impact of building envelopes on HVAC equipment. Here’s a quick rundown from their study:

- Electrification and heat pumps are redefining the core product mix. Air-to-air and cold-climate heat pumps with variable-speed inverters are displacing fossil systems in both new build and replacement; dual-fuel hybrids persist where grid or envelope constraints exist.

- Inverter and VRF technologies push comfort. Variable-speed compressors and ECM motors deliver tighter temperature/humidity control, lower noise, and higher SEER/HSPF ratings across diverse climates. Simpler line sets, pre-charged kits, and app-guided commissioning reduce callbacks, improve installations, and preserve warranty integrity.

- Refrigerant transition continues. Moving away from legacy refrigerants to lower-GWP options requires charge-size management, new safety features, and installer certification.

- IAQ and ventilation have become baseline, not upsell. Filtration beyond standard minimums, humidity control, and germicidal options are required for wellness-minded homeowners. Packaged solutions that balance ventilation with energy recovery and tight envelopes avoid comfort penalties. Data-backed solutions increase perceived value and justify premium service plans.

- Connected controls and service platforms unlock lifetime value. Smart thermostats, cloud telemetry, and predictive maintenance convert intermittent installs into recurring relationships.

Click Below for the Next Page:

Recent Comments