Policy Versus Party – What Matters?

To compound matters, we have officially entered a presidential election year. With the fact that the U.S. economy is slowing down, that makes two converging trends likely to yield grotesquely irresponsible economic reporting and high uncertainty during the next year.

We are known for being apolitical at ITR Economics; we do not favor either political party when it comes to our analysis of the overall economy. A policy can matter, but history has shown us that the party in the White House does not.

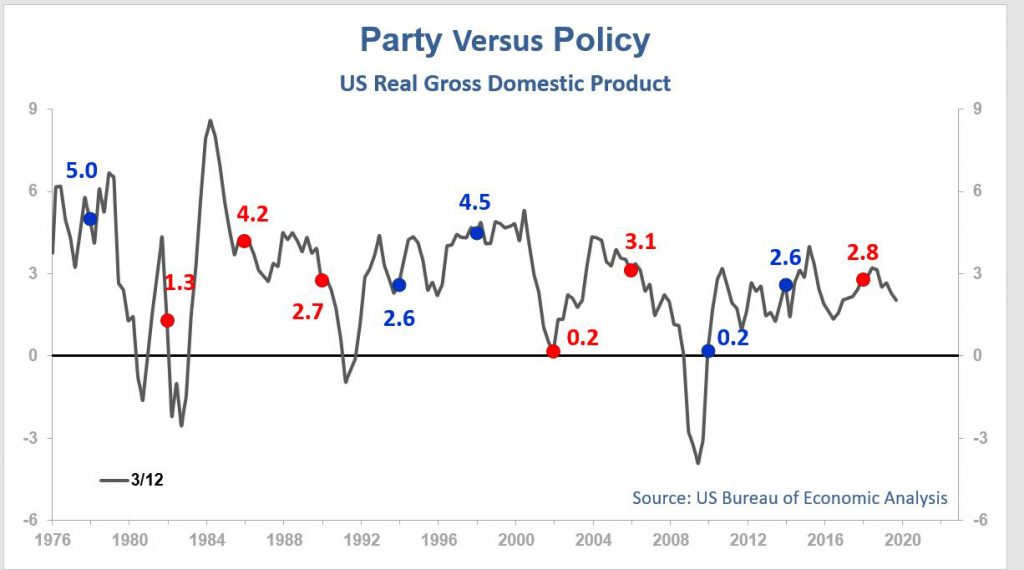

The chart illustrates one of the reasons why. The quarterly growth rate for the U.S. GDP (adjusted for inflation) is presented. The blue dots mark the end of the first year of a Democrat’s term in the Oval Office; the red dots depict the same for a Republican. From our perspective, it is not possible to statistically demonstrate that superior growth, or the lack thereof, can be laid at the feet of one party or the other.

From 1976 to the present, the average GDP rate-of-change during Republican administrations was 2.81%; for Democratic administrations, the average was 2.85%. All of which leads us to the point we strive to make in our presentations and conversations: Its policies and what ultimately becomes law or rule or executive order that can (at times) matter, not the party.

At ITR we will keep an eye on any proposed policies that gain ground as the election cycle heats up and provide commentary on whatever business implication they may have. Your job as a reader is to keep your head above the political noise this year and focus on running the business.

The ‘People Problem?

Despite the macroeconomic slowdown underway and mild headwinds for the industry, finding and keeping talent will remain a big issue.

U.S. Employment of Building Equipment Contractors ‘ which includes electrical and wiring installation contractors; plumbing, heating, and air conditioning contractors; and other building equipment contractors ‘ is averaging an all-time high of 2.25 million individuals during the most recent 12 months.

Hiring is showing tentative signs of slowing, but Employment is still up 4.0% from the same period a year ago. While you should expect hiring to slow nationally into 2020, the trend will stop well short of the rising unemployment typically observed during macroeconomic downturns.

This is not that kind of cycle. Try to leverage the slower growth next year by hiring more talent to prepare you for the next growth cycle.

The challenge for those in the commercial HVAC space in 2020 will be balancing a slowing economic environment and the bluster and noise emanating from the media surrounding the 2020 general election.

Evaluate your cash position and stay flexible with adequate access to credit as the bottom of the business cycle approaches, with the main goal of avoiding being overly pessimistic in your thinking. We expect accelerating growth in GDP to be gaining traction later in 2020, with greener pastures awaiting in 2021.

Will you be ready to meet that level of demand? Ask yourself how you can leverage the current pause in the business cycle to load up for the next upswing.

Connor Lokar is a Program Economist at ITR Economics, a 72-year-old economic research and consulting firm. Lokar specializes in the construction industry and provides economic consulting services for businesses, HVAC trade associations, and Fortune 500 companies. He is a graduate of the economics department of the University of Michigan. His economic insight and forecasting experience play a key role in ITR Economics? 94.7% forecast accuracy. To learn more about ITR Economics, visit www.itreconomics.com. Follow Lokar on LinkedIn (ncilink.com/ConnorLokar).

Recent Comments